Why pack our adventure travel insurance cover?

We want you to get the most out of your holiday – and for you to hike more, scuba more, bungee more, and kayak more (if that’s what floats your boat). When you holiday with us, you can enjoy your favourite activities and extreme sports, safely.

It’s fun

You get cover for 80 awesome sports and activities, no matter which plan you choose. Who knew that many existed?!

It’s flexible

You can choose one of two Adventure Activities Cover levels if your heart-racing activity isn’t automatically included in our plans.

It’s dependable

You get access to emergency assistance at any time, from anywhere – from people who care.

It’s supportive

You can get overseas medical cover for broken bones and more, so you can focus on getting better – not on paying all the bills.

What you get with our adventure travel insurance cover

We know you love a bit of heart-racing fun. That’s why we include cover for 80 activities in our base plans and offer two cover options for those who really like to raise their heart rate on holiday.

We also cover what we say we will, so have a quick look at the tables below to see what’s covered, what’s not, and the cover limits. Because if it’s not covered by your policy, we probably won’t be able to pay the bill.

You should also peek at the Product Disclosure Statement (PDS) – it’s the source of truth when it comes to our limits, exclusions, and conditions. Yes, it might sound dull (it is a bit) but you need to read it to help you choose the best travel insurance that covers sports for you and your trip.

Important bits for you to know:

*Limits, sub-limits, conditions, and exclusions apply. Please read the PDS for all the details.

Uncover more about our travel insurance for adventure travel

Our two cents? Have fun but remember your own limits. Wear SPF50 top to toe, even if it’s cloudy. And get to know our cover before you buy.

If you’re the ‘ants in your pants’ type, your holidays likely aren’t only about discovering new cultures, tasting unfamiliar foods, or experiencing scenery you’ve never seen before… they also give you a chance to try out some fun sports and activities, or help you tick off a bucket-list challenge.

However – sorry to be a party pooper – with great adventure comes the greater chance that not everything will go to plan. This can make travel insurance even more important than, say, if you were going on relaxing, lie-by-the-pool holiday.

Whether you’re planning on doing something less intense like snorkelling off the island of Boracay in the Philippines or rollerblading in Miami, or something a little more daring like trekking to Mount Everest Base Camp or scuba diving on the Great Barrier Reef, travel insurance for adventure travel is a must if you want support when something goes awry.

But! Not all travel insurance plans are created equal, and not all insurance providers will offer travel insurance that covers sports, so you’ll need to read the trusty PDS for what is and isn’t covered when it comes to adventure travel insurance cover or extreme sports travel insurance for your heart-pumping trip.

Don’t say we didn’t tell you: When comparing travel insurance plans, it’s a good idea to note which adventure activities are automatically covered and which activities you’ll need extra cover for. It’s your responsibility to make sure you’ve got the cover you need for your holiday plans (or you’ll get a nasty surprise if something goes wrong and you’re not covered…).

You sports-mad, adventure types will be happy to know that all our travel insurance plans automatically include cover for 80 adventure activities. (Who knew there were that many adventure activities?!)

To find out what popular activities and sports we automatically include in all our plans (whether you’re travelling in Australia or overseas), take a look at the table above, or read the full list in the PDS.

Don’t see your planned activity in this list? Don't fret – it might be included in one of our optional activity packs: Adventure Activities and Adventure+ Activities. (Check out the tables above for the details.)

Can’t find it listed in those either? We may still be able to cover it. Call us on 1300 72 88 22 to find out.

Don’t say we didn’t tell you: For cover to apply, you can only enjoy all the activities listed recreationally and in a non-professional capacity. (Sorry to all those planning to be the next Cathy Freeman and Mick Fanning!) Limits, sub-limits, conditions, and exclusions apply to our cover, so don’t forget to read the PDS before you buy.

It’s way easier than wind surfing! (Well, at least we think it is.)

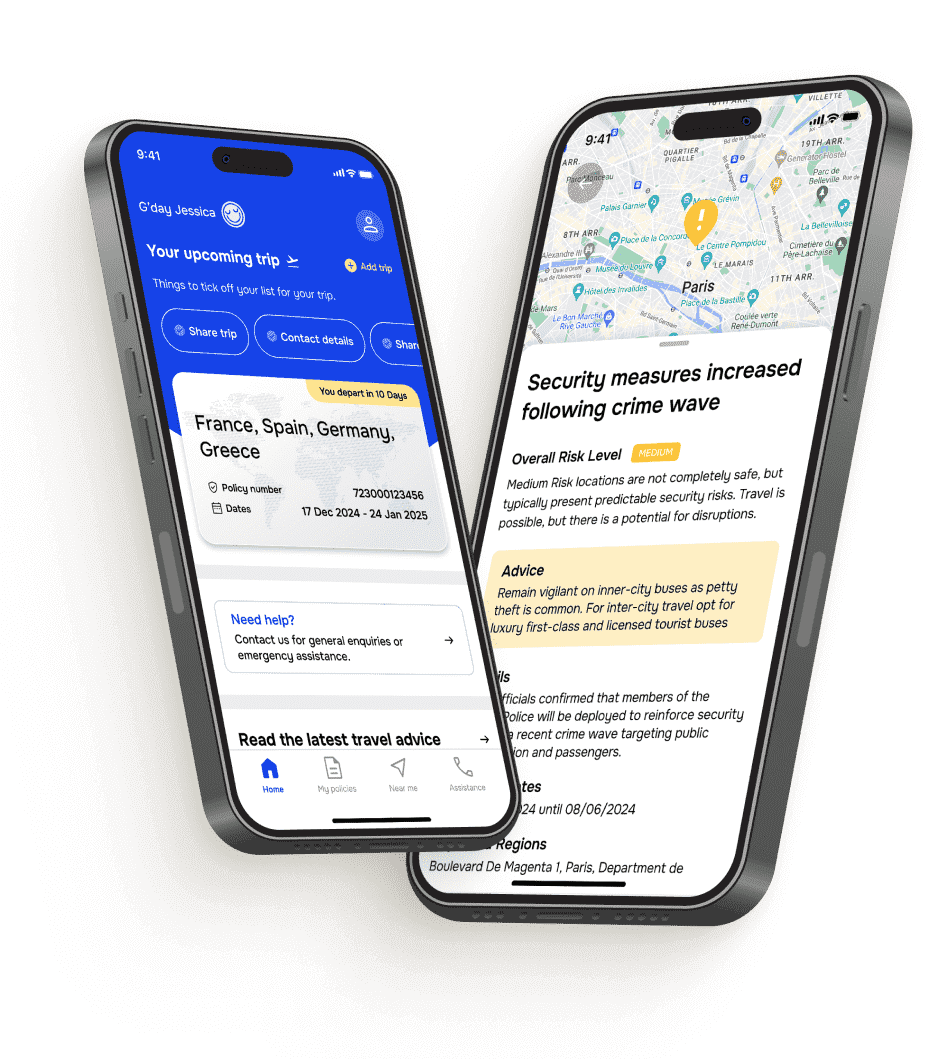

First, you’ll want to get a quote either by clicking on one of our quote buttons (there’s one and at the top and bottom of this page) or by calling our team on 1300 72 88 22. This is where you’ll tell us your destination, dates of travel, and details of any other travellers you want to include on your policy.

Next, select the travel insurance plan that suits your holiday – this might be the Basic, Comprehensive, or Comprehensive+ plan, depending on how much coverage you want and how much you want to spend. If you’re unsure about what coverage you need, you can compare our travel insurance plans here.

Once you’ve decided on the plan (which will already include 80 activities), you’ll need to select ‘Yes’ when asked if you’ll be doing any sports or activities not covered by our base plans. You’ll then have two optional activity packs available to choose from: Adventure Activities and Adventure Activities+. You know the drill – pick the one you need for your planned activities and pay the extra premium to include it in your policy.

You can also choose your level of cancellation cover or increase your luggage limits at this time – they might be useful if you’ve prepaid for your activities or you’re travelling with pricey adventure gear. Note to self: we don’t cover sports equipment when it’s in use, so make sure you take good care of it!

Still need help understanding which cover is best suited to your trip? Call our team on 1300 72 88 22.

Unfortunately, there are some activities we just can’t cover because they are super risky. (Yes, if you do them, you’re basically asking for trouble – and travel insurance is here to protect you from the unexpected, not the ‘oh boy, we could see that coming from a mile away’.)

Our travel insurance won’t cover you for:

- Hunting

- Rodeo riding

- BASE jumping

- Hang gliding

- Motocross

- Running with the bulls

- Doing a sports activity in a professional capacity

- Free climbing

- Mountaineering using guides, ropes, rock climbing equipment, or oxygen

- Trekking greater than 6,000 metres above sea level

- Scuba diving to a depth of 30 metres below the surface unless you hold an Open Water Diving Certificate or are diving with a qualified diving instructor

- Scuba diving if the maximum depth is greater than 50 metres below the surface

- Racing (other than swimming races of 10 kilometres or less or running races that are marathon distance or less).

If you’re not sure if the sport or activity you’re planning on doing is covered, give us a call on 1300 72 88 22. We’ll be happy to chat.

This may be a bit complex but stick with us! (It’ll be worth it.)

We can provide cover for adventure activities, winter snow sports, and motorbike riding, but they aren’t all covered under our Adventure Activities Cover.

Our Adventure Activities Cover provides protection while you’re doing the activities listed in the tables above. (Can’t be bothered to scroll up? It’s in the ‘What you get’ section.)

You’ll notice some popular snow holiday activities are covered under our Adventure Activities Cover section – such as ice fishing, ice skating, sledging/tobogganing, and sleigh riding – but for popular winter snow sports, you’ll need to include our Snow Sports Cover in your policy for cover to apply.

We have two levels of Snow Sport Cover that can protect you when you go skiing, snowboarding, or snowmobiling:

- Snow Sports: cover only for on-piste snow skiing, snowboarding, and snowmobiling, and cross-country skiing

- Snow Sports+: includes cover for the above activities, as well as off-piste snow skiing/boarding (as long as you aren’t going against local advice – that’s just silly; the locals know best!), and heli-skiing/boarding with a guided, licensed tour operator.

Take a snoop at the PDS for full policy conditions, limits, and exclusions before deciding if one of our snow sports cover options are right for you. (Don’t wait until you hit the slopes, though – that’s just silly.)

Want to know more? Visit our Snow Sports Cover page for more details and answers to FAQs or check out the PDS.

You’ll also notice some popular two- and four-wheel holiday activities are covered under our Adventure Activities Cover section – such as cycling for fun and quad-biking on an organised day tour – but when it comes to riding a motorbike, you’ll need to include our Motorcycle/Moped Riding Cover in your policy for cover to apply.

We offer two levels of cover for riding motorcycles (or mopeds):

- Motorcycle/Moped Riding: for engine capacity 250cc or less

- Motorcycle/Moped Riding+: for unlimited engine capacity (conditions apply).

Before we forget: You’ll need to include this optional cover in your policy whether you’re planning to be the driver or passenger of the motorcycle or moped. Oh, and you must always wear a helmet. Never forget the helmet!

Want to know more? Visit our Motorcycle/Moped Riding Cover page for more details and answers to FAQs or check out the PDS for all the bits and bobs (and rules!) you need to know about this cover.

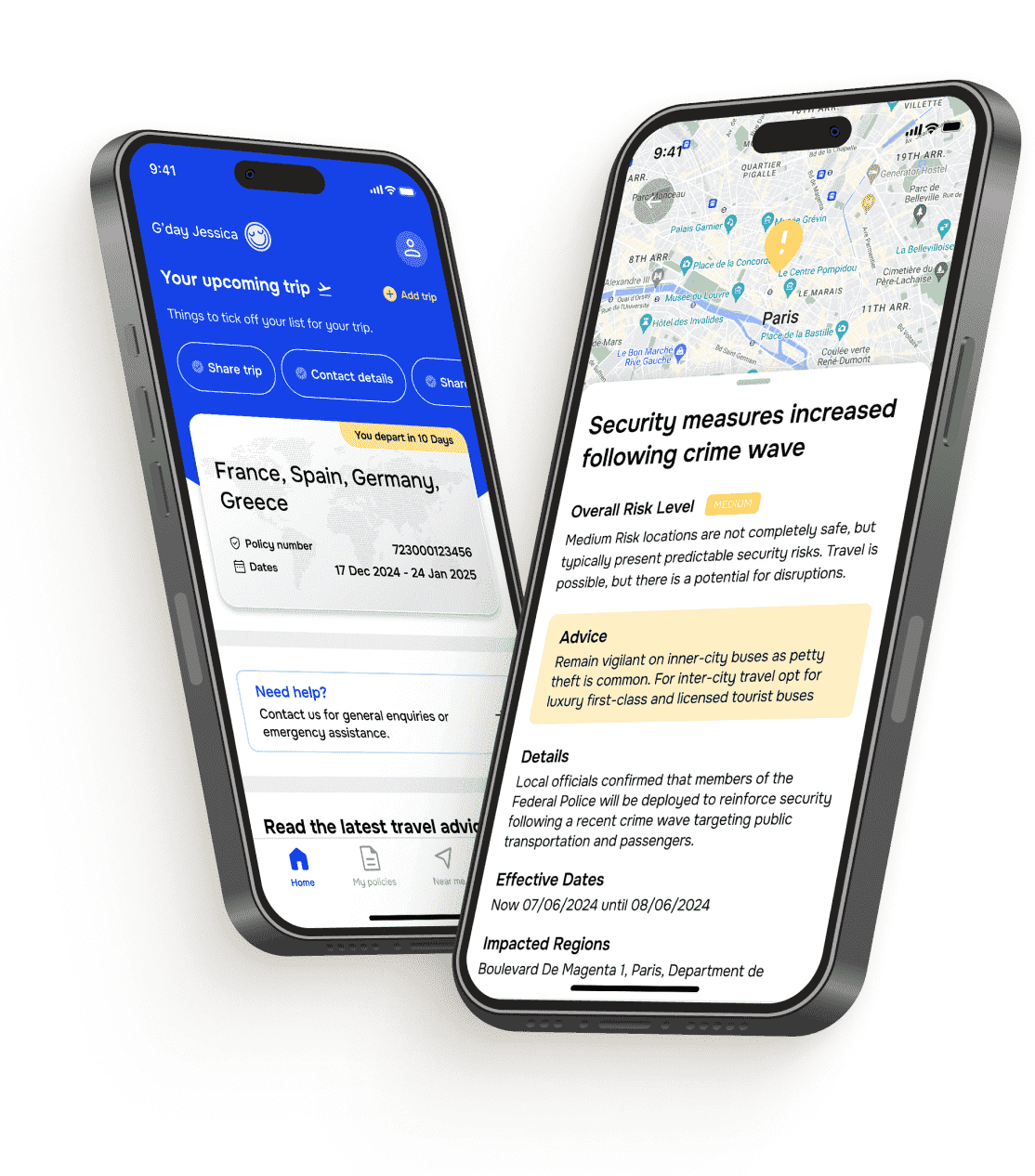

Want more care with your cover? We’re here for our global travellers

~300,000

The number of assistance calls we get each year from travellers who are in a pickle and need help.

~50,000

The number of assistance cases we handle each year (AKA travellers who need medical, safety or travel help).

~1,400

The number of medical evacuations and repatriations we help make happen each year for our travellers in need.

85,000+

The number of brilliant hospitals, doctors in our global network who help and support you overseas.

This is how our global Cover-More assistance team (also known as World Travel Protection) supported travellers across all our Zurich Cover-More brands and other third-party businesses in 2024 from our dedicated emergency travel assistance Command Centres located in Brisbane (Australia), Toronto (Canada) and London (UK). Want the global actuals for our 2024 assistance stats? They are: 294,491 assistance calls, 47,395 assistance cases, and 1,362 repatriations/evacuations.