Why pack our travel insurance with pre-existing medical conditions cover?

Travel sparks joy and lifelong memories, but it can get a little tricky with a medical condition. Take our cover with you to help you explore to your heart’s content – and keep health-related worries at bay.

It's extensive

You get cover for 30+ pre-existing conditions included automatically (if you meet the criteria in the PDS) in all our base plans – no extra cost, no extra hassle!

It’s flexible

You can include cover for existing medical conditions not already included in our base plans. (FYI: an extra cost may apply.)

It’s reliable

You get 24/7 access to our top-notch emergency assistance team. If things take a turn, you can lean on them.

It’s adaptable

You can get existing medical conditions cover with both our domestic and international plans. Wherever you’re off to, we’ve got you!

What you get with our existing medical conditions cover

Everyone deserves to worry less on their dream trip – and our travel insurance with cover for pre-existing conditions can help you do just that.

We cover what we say we will. So, have a look at the table below to see which existing medical conditions are automatically covered by us. You’ll also find the list of criteria your condition(s) need to meet for this automatic cover to apply below the table. (It’s important – don't skip it!)

Can’t spot one or all your conditions in the table? Or your conditions don’t meet all the criteria? That’s OK – you can tell us about it via our online health assessment when you’re getting a quote. It’s easy to complete and doesn’t take too long. Plus, we’ll let you know instantly if we can cover your condition(s) and if there’ll be an extra cost.

Heads up: The conditions we automatically include only apply if you don’t have other existing medical conditions outside that list. If you do, you’ll just need to tell us about all your conditions in your online health assessment to avoid missing out on the chance to get cover! (And yes, all means all – even the ones on our ‘automatically included’ list.)

In the last 12 months, your prescribed medication hasn’t changed.

You are not currently waiting to see a mental health clinician (e.g. psychologist or psychiatrist).

You have not previously been required to cancel or curtail your travel plans due to your anxiety.

In the last 12 months, you haven’t had an asthma exacerbation requiring treatment by a medical practitioner.

You have been a non-smoker for at least the last 18 months.

You don’t need prescribed oxygen outside of a hospital.

You don’t have a chronic lung condition or disease (whether chronic or otherwise) including chronic bronchitis, chronic obstructive pulmonary disease (COPD), emphysema or pulmonary fibrosis.

You have no ongoing complications of this condition.

glaucoma

You have no ongoing complications of this condition.

In the last 12 months, your prescribed medication hasn’t changed.

You are not currently waiting to see a mental health clinician (e.g. psychologist or psychiatrist).

You have not previously been required to cancel or curtail your travel plans due to your depression.

You don’t have an underlying medical condition (e.g. previous head trauma, brain tumour or stroke).

Your gastric reflux doesn’t relate to an underlying diagnosis (e.g. hernia/gastric ulcer).

No additional criteria.

No additional criteria.

No additional criteria.

No additional criteria.

knee replacement

shoulder replacement

hip resurfacing

The procedure was performed more than 12 months ago and less than 10 years ago.

You haven’t had any post-operative complications related to that surgery. Post-operative complications include joint dislocation and infection.

You don't have a known heart or cardiovascular condition.

You don’t have a known heart or cardiovascular condition.

You don’t have diabetes (type I or type II).

Your hypertension is stable and managed by your medical practitioner.

In the last 12 months, your prescribed blood pressure medication hasn’t changed.

You aren’t suffering symptoms of hypertension.

You aren’t having investigations related to blood pressure.

No additional criteria.

gastric ulcer

In the last 12 months, the peptic/gastric ulcer has been stable.

No additional criteria.

No additional criteria.

Your skin cancer isn’t a melanoma.

You haven’t had chemotherapy or radiotherapy for this condition.

Your skin cancer does not require any follow-up treatment e.g. chemotherapy, radiotherapy or further excision.

No additional criteria.

No additional criteria.

overactive thyroid

The cause of your underactive/overactive thyroid wasn’t a tumour.

Don’t forget

The PDS has all the details on our cover, including this important information:

We automatically include the existing medical conditions listed in the table above as long as:

• all your existing medical conditions are on this list;

• you have not been hospitalised or required treatment by a medical practitioner in the last 12 months for any of the listed conditions;

• you are not under investigation for any of the listed conditions;

• you are not awaiting investigation, surgery, treatment or procedures for any of the listed conditions; and

• your condition satisfies the criteria in the table following. All time frames are measured in relation to the relevant time, unless specified otherwise.

Uncover more about our travel insurance for pre-existing conditions

Our two cents? Pack all your meds in your carry-on bag. Take a reusable water bottle to keep hydrated while you’re out exploring. And get to know our cover before you buy.

If you’re wondering what counts as an existing medical condition for travel insurance, we can help. But, it’s good to know this: every travel insurance provider will answer this one a bit differently.

At Cover-More, this is what an ‘existing medical condition’ means to us: a disease, illness, medical or dental condition or physical defect that, at the ‘relevant time*’, you were aware of or a reasonable person in your circumstances could be expected to have been aware of, by reference to all relevant factors including whether it meets any one of the following:

- It involved (has required) a trip to an emergency department, hospitalisation or a day surgery in the past 12 months.

- It needs prescription meds from a doctor, regular check-ups, ongoing treatment or risk factor control, or specialist consultations.

- It's a documented medical condition affecting the brain, circulatory system, heart, kidneys, liver, respiratory system, or involved cancer.

- It involved surgery on the abdomen, back, brain, joints or spine that needed at least an overnight stay in hospital.

- It is chronic or ongoing (whether chronic or otherwise) and medically documented, or is under investigation, pending diagnosis or pending test results.

*The big print: Want to know what ‘relevant time’ means? Well, it depends which policy type you’ve got:

- If you’ve bought a single trip policy (AKA it covers a one-off trip), it’s the time your policy was issued.

- If you’ve bought an annual multi-trip policy (AKA it covers multiple trips), it’s either the time your policy was issued or the first time you paid for any part of the trip in question – whichever happens last.

Yes, we can! So, if you’re trying to work out how to get travel insurance with a pre-existing condition, you’re in the right place.

Here’s some more good news: we automatically cover many existing medical conditions in our base plans. You’ll be eligible for this cover if at the time you buy your policy:

- all your existing medical conditions are on our list of automatically covered conditions

- you haven’t been hospitalised or needed treatment by a medical practitioner in the past 12 months for any of the listed conditions

- you aren’t under investigation for any of the listed conditions

- you aren’t waiting for investigation, surgery, treatment, or procedures for any of the listed conditions

- your condition meets the criteria outlined in the PDS.

Not spotting your pre-existing conditions on the list of ones we automatically cover? Don’t worry – we may still be able to help. Just pop all your existing medical condition details (yes that includes anything you take prescribed meds for) into our online health assessment. You’ll come across it when you’re getting a quote.

If your existing medical condition(s) get the green light after you take the health assessment, then we can offer you cover – and you can choose to include this cover in your policy. Just a heads up, though: there might be an extra cost to include this cover to your policy. If you choose not to include the cover in your policy, you won’t be covered for any claims that relate to or arise from any of your existing medical conditions.

Want to find out if we can cover your conditions? Why not get the ball rolling by getting a quote and completing an online health assessment?

Yes, you do. Skip this important step and you mightn’t have cover for your medical conditions.

If you buy our cover and all your conditions aren’t on our list of automatically included conditions, your conditions don’t meet all the criteria, or you have a combination of conditions on the list and not on the list, any claims related to your condition(s) won’t be approved. Yes, you’ll be left footing the bill if things go pear-shaped because of your undeclared conditions.

What does this look like in real life? Here are two possible realities:

- You don’t declare you’ve got endometriosis, and a flare up causes you to miss a pre-booked tour, flight and a few nights of accommodation while you’re abroad because you needed to stay put to help manage your pain. We won’t be able to help cover any of the costs related to this – you’ll be left to pay new bills and lose any non-refundable prepaid costs.

- You don’t declare you’ve got a history of basal cell carcinoma (BCC) – or that you’ve recently had one cut out. While you’re away, the treated area gets infected. You ignore it because you think it’ll just get better. But then the infection leads to sepsis and lands you hospital for multiple nights in a foreign country. You’ll be left paying the bills – not us – which could be expensive.

Our two cents? Don’t risk it for the biscuit. Always share all your medical conditions with us.

Because if you declare your conditions(s) and include the cover in your policy, you could be reimbursed for unused prepaid costs or unexpected extra expenses if your declared medical condition causes issues on your trip.

It’s super simple. When you’re getting a quote, we’ll ask you if you’ve got any existing medical conditions. If you say yes, you’ll be directed to our online health assessment.

You’ll be asked to list each of your existing medical conditions. (For some conditions, you’ll be asked a few quick questions to help us understand more about your situation and how the condition affects you. For other conditions, there may be a fair few questions we need to ask you.) Please don’t tell us any porkies – you have to spill the beans on every single medical condition you have and answer all the questions truthfully. If you don’t, it can throw a spanner in the works if you need to make a claim later.

When you’ve finished the online health assessment, we’ll review what you’ve shared. After a few moments, we’ll let you know if we can cover your conditions. If we can, you’ll then have the option to include the cover in your policy. If there’s an extra cost attached to this cover, we’ll be upfront about that too.

If you need any extra help, you can ring our team on 1300 72 88 22 – they'll help you through the process.

Read the big print: Not telling us about an existing medical condition could affect any claim you make that’s related to your health. It’s all explained in our PDS. Look at it to get your head around the nitty gritty before you buy.

We’re big on helping you travel more and worry less. But, unfortunately, we can’t cover absolutely everything.

While we can cover a lot of conditions (and some tricky combos), there are some we just can’t. If we tell you we can’t cover any of your existing medical conditions, it means any claims directly or indirectly related to those conditions won’t be covered.

The good news? You can still get cover for other travel curveballs (that don’t involve your uncovered conditions) with our travel insurance plans. (Read: missed connections, stolen passports, luggage delays, and more.) Our caring emergency assistance team is also here to help you 24/7, whether you have a covered condition or not.

Remember: We will never approve claims that are linked to or made worse by:

- medical conditions that are undiagnosed or awaiting specialist opinion;

- conditions involving drug or alcohol dependency;

- travel booked or done against any medical practitioner’s advice;

- routine or cosmetic medical or dental treatment or surgery on your trip (even if you medication condition is approved and added to your policy); or

- conditions where you’re travelling to seek advice, treatment or join to clinical trial.

So, double check our cover is right for you, your health satiation and your travel plans before you buy.

You can reach our team on 1300 72 88 22 if you’ve got questions on this. (We know it’s a bit complex, but so are our bodies!)

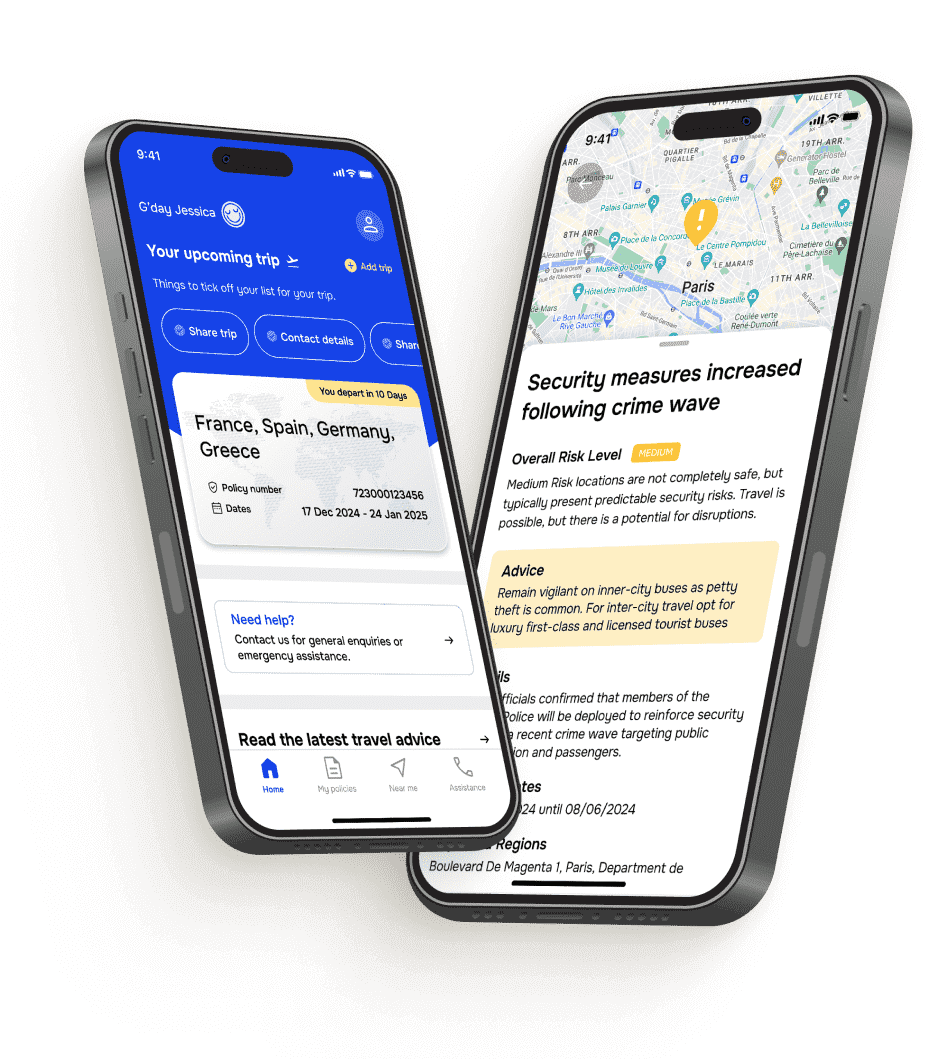

Want more care with your cover? We’re here for our global travellers

~300,000

The number of assistance calls we get each year from travellers who are in a pickle and need help.

~50,000

How many of you we’ve repatriated or evacuated home to Australia to get the care and support you needed.

~1,400

The number of medical evacuations and repatriations we help make happen each year for our travellers in need.

85,000+

The number of brilliant hospitals, doctors in our global network who help and support you overseas.

This is how our global Cover-More assistance team (also known as World Travel Protection) supported travellers across all our Zurich Cover-More brands and other third-party businesses in 2024 from our dedicated emergency travel assistance Command Centres located in Brisbane (Australia), Toronto (Canada) and London (UK). Want the global actuals for our 2024 assistance stats? They are: 294,491 assistance calls, 47,395 assistance cases, and 1,362 repatriations/evacuations.