Why pack our Special Events travel insurance cover?

Say yes to celebrating your mate’s destination wedding, finally seeing your favourite band in another city, or cheering for your team at an away game. If things don’t go to plan along the way, we’ll be here to help.

It’s flexible

You can pick from domestic or international cover options to make your cover match your epic travel plans.

It’s dependable

You can choose to include optional cancellation cover, in case something unexpected happens before you set off.

It’s reliable

You’ll be able to lean on our 24/7 emergency assistance team if things go awry while you’re travelling.

It’s extensive

You get cover for 80 adventure activities automatically if you want to jam even more excitement into your trip.

What you get with our Special Events travel insurance cover

When you take our cover as your ‘plus one’, you can worry less. Yes, our cover can help you spend more time soaking up the moment instead of thinking about what could go wrong.

But remember: We cover what we say we will. So, check out the table below to see which plans include our Special Events travel insurance cover, plus the maximum cover limits.

You should also read our Product Disclosure Statement (PDS) – it’s the source of truth when it comes to our limits, exclusions, and conditions. Yes, it is a little long. But, reading it’ll help you pick the right level of travel insurance cover for your getaway – and you can check if the event you’re going to is included in your cover.

Uncover more about our Special Events travel insurance

Our two cents? Buy tickets to see that bucket list band or game. Make sure your phone’s fully charged before you go. And get to know our cover before you buy.

Got tickets to see your favourite band interstate or overseas? Heading to a big fat destination wedding? Or maybe you’re following your sports team across borders in hope of victory and are looking into travel insurance for sporting events?

Special events don’t come around that often, so it’d be a shame to be late (or miss out completely) because of a travel delay. That’s where our Special Events travel insurance cover can kick in to save the day.

If unexpected travel delays throw a wrench in your plans, you can lean on us. Our Special Events cover can help with reasonable additional costs for alternative (public) transport to get you there on time. Plus, we can reimburse the cost of the original transport you didn't use because of the delays (minus any refund or credits from the provider). There are limits and exclusions that apply to our cover, so make sure you read about our Special Events cover in our PDS before you buy.

Here at Cover-More, we count these as special events:

- Weddings

- Funerals

- 25th or 50th wedding anniversary celebrations

- Pre-paid conferences

- Pre-paid concerts

- Pre-paid music festivals

- Pre-paid sporting events

So, if you’re travelling to go to any of the above events, packing our cover could be a smart idea.

When it comes to our Special Events travel insurance cover, the term ‘additional costs’ means the cost of the transport you actually use, minus the cost of the transport you originally planned to use. (For example, the new flight you had to book because your original one was cancelled for a covered reason, and you were going to miss the start of the event if you didn’t get on another flight.)

No, our Special Events cover doesn’t apply if your event is cancelled. Not to worry – our Cancellation Plus cover option might help. It may cover your cancelled travel arrangements if you cancel your trip because your event is cancelled (but only in some scenarios!). You’ll have to pay an additional cost to include this option in your policy, so check the PDS to make sure it’s got the cover you’re after.

Travel insurance can’t cover absolutely everything. When it comes to our Special Events cover, we can’t cover claims caused by an epidemic, pandemic or outbreak of an infectious disease, or viruses. We also can’t cover claims that arise because of circumstances listed in our general exclusions.

So, don’t forget to read our PDS – it's the source of truth for full limits, exclusions, and conditions. Once you’re done, you can get back to planning your trip – whether that means playing the artist’s latest tunes, bridesmaids dress shopping, writing in an anniversary card, or cleaning your team’s guernsey.

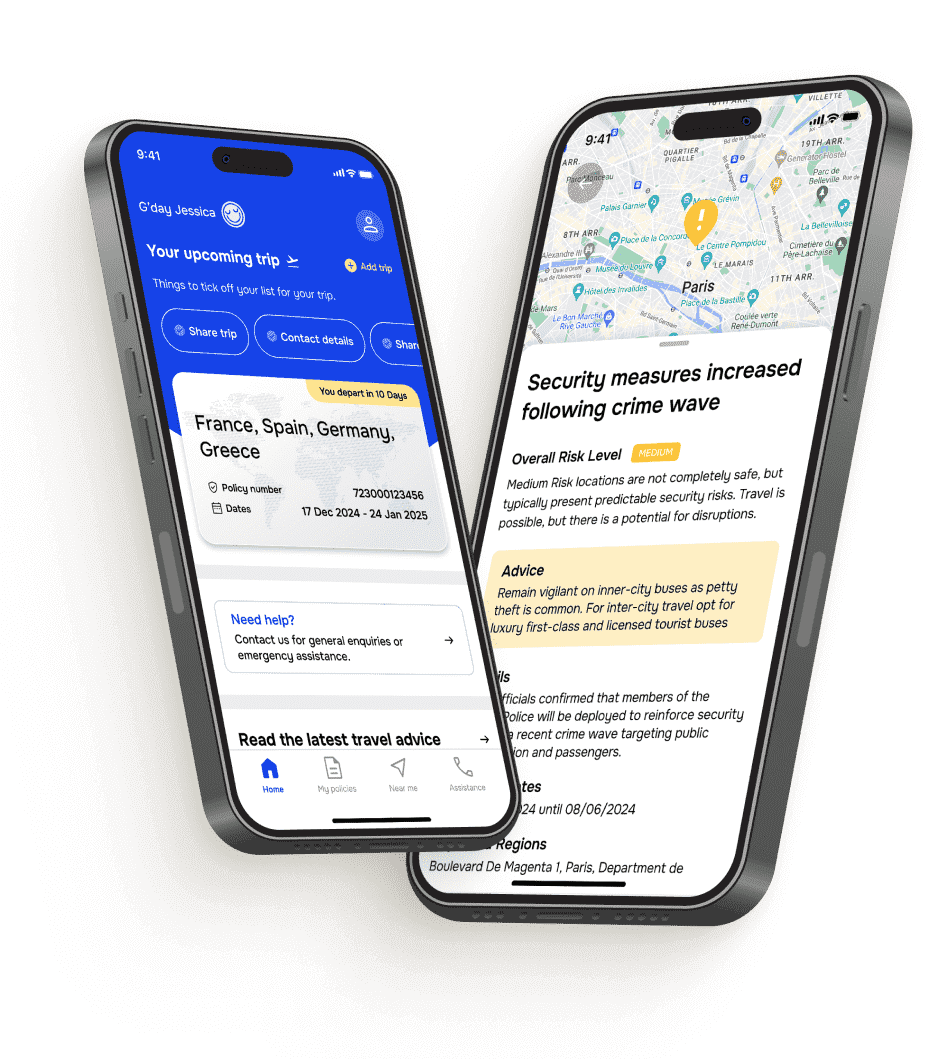

How we’ve helped our Cover-More travellers (hint: it’s a lot!)

~300,000

The number of assistance calls we get each year from travellers who are in a pickle and need help.

~50,000

The number of assistance cases we handle each year (AKA travellers who need medical, safety or travel help).

~1,400

The number of medical evacuations and repatriations we help make happen each year for our travellers in need.

85,000+

The number of brilliant hospitals, doctors in our global network who help and support you overseas.

This is how our global Cover-More assistance team (also known as World Travel Protection) supported travellers across all our Zurich Cover-More brands and other third-party businesses in 2024 from our dedicated emergency travel assistance Command Centres located in Brisbane (Australia), Toronto (Canada) and London (UK). Want the global actuals for our 2024 assistance stats? They are: 294,491 assistance calls, 47,395 assistance cases, and 1,362 repatriations/evacuations.