Why pack our snow sports travel insurance cover?

When you holiday with us, we’ll be right here on the sidelines cheering you on. Because if you stay upright on the slopes, you can shred more, board more, and laugh more on the mountain.

It’s flexible

You can choose one of two Snow Sports Cover levels to find the one that suits your trip activities and skill levels.

It’s supportive

You get overseas medical cover for broken bones and more, so you can focus on getting better – not on paying all the bills.

It’s dependable

You get access to emergency assistance at any time, from anywhere – from people who care.

It’s useful

You can get luggage cover for the stuff you pack, like your snow jackets and pants, gloves, ski googles, thermals, and more.

What you get with our travel insurance with snow sports cover

We know you enjoy a good winter holiday. That’s why we have two cover options so you can hit the slopes with the cover you need.

We also cover what we say we will, so have a quick look at the tables below to see what’s covered, what’s not, and the cover limits for our two levels of Snow Sports Cover. Because if it’s not covered by your policy, we won’t be able to pay the bill.

Uncover more about our winter sport travel insurance cover

Our two cents? Wear sunscreen on the slopes, even if it’s cloudy. Pack a few snacks in your snow jacket pockets. And get to know our cover before you buy.

Some people call it ski travel insurance, snowboarding travel insurance or even winter sports travel insurance, but whatever you want to call it, travel insurance for snow sports is a unique kind of cover that can protect you on and off the mountain. Because winter sports trips aren’t like relaxing beach holidays – they come with risks you likely won’t come across on a sun lounger.

If you’re hitting the slopes, this type of insurance can help cover unforeseen costs if you have a slip on the slopes and need medical assistance, as well as protect your snow gear. It’s super important to consider, because while snow-based holidays are fantastic fun, doing winter sports can increase your risk of injury. You’re also likely to be travelling with more stuff – often more expensive stuff – so it’s smart to get cover that includes luggage cover, too. You’ll know this if you’ve checked the PDS, but don’t forget we can’t cover your gear when it’s in use. So, take good care of it, yeah?

Good to know: Most insurers (including us!) will charge an extra premium for you to include cover for winter sports in your policy. Snow sports are fun, but they’re also a little risky.

Whether you want travel insurance for skiing in Japan, a snowboarding adventure in New Zealand, or snowmobiling fun in Canada, our Snow Sports Cover offers protection for the popular winter sports you might want to try on your snow trip. If you pack our cover and something does go wrong on the slopes, we can help care for you.

Snow-related injuries don’t just happen to beginners. So, even if you’ve been carving up the mountains for years, our cover could help you if you take a tumble. Remember: ski fields are often isolated and have rugged terrain, which means it can cost a pretty penny to airlift you off the slopes and get you to the nearest hospital for medical assistance if you need it. Hospital bills can also be pricey – and unpredictable.

But you can worry less when you travel with us, because we’ve got you. We’re here for the good times and the not-so-good times. There’s no mountain our 24/7 assistance team isn’t happy to climb (metaphorically speaking!) to help you get the care you need.

Plus, when you include either one of our two levels of snow sports travel insurance in your travel insurance policy, you can access all our other great coverage. Think: protection for your luggage, travel delays, additional expenses, and more.

So, if you’re planning to don some snow boots and ski, snowboard or snowmobile on your next trip, consider choosing our travel insurance for winter sports holidays.

We do indeed! We offer two levels of winter sports travel insurance cover so you can choose the one that suits your trip plans best.

Here they are:

- Snow Sports: This cover option could be great if you’ll be spending your time doing on-piste skiing, snowboarding, snowmobiling, and/or cross-country skiing. It doesn’t offer cover for off-piste or backcountry skiing.

- Snow Sports+: This cover option includes cover for the above activities, plus off-piste skiing and snowboarding, and guided heli-skiing and heli-boarding tours. It could be the option for you if you’re more advanced at snow sports or planning to do more adventurous activities on the mountains.

Note to self: Even if you include one of our Snow Sports or Snow Sports+ cover options in your policy and pay the additional premium, you’ll only have cover if you meet the conditions outlined in the PDS. For example, you can’t be a pro-skier or boarder, must not be racing, must always follow local advice and warnings, and more.

Also, be good while you’re out on the slopes. Always familiarise yourself with your ski resort’s guidelines and only take on the runs that are within your ability. We want you to have fun, but we also want you to come home safely.

Ready to buy? Get a quote online now.

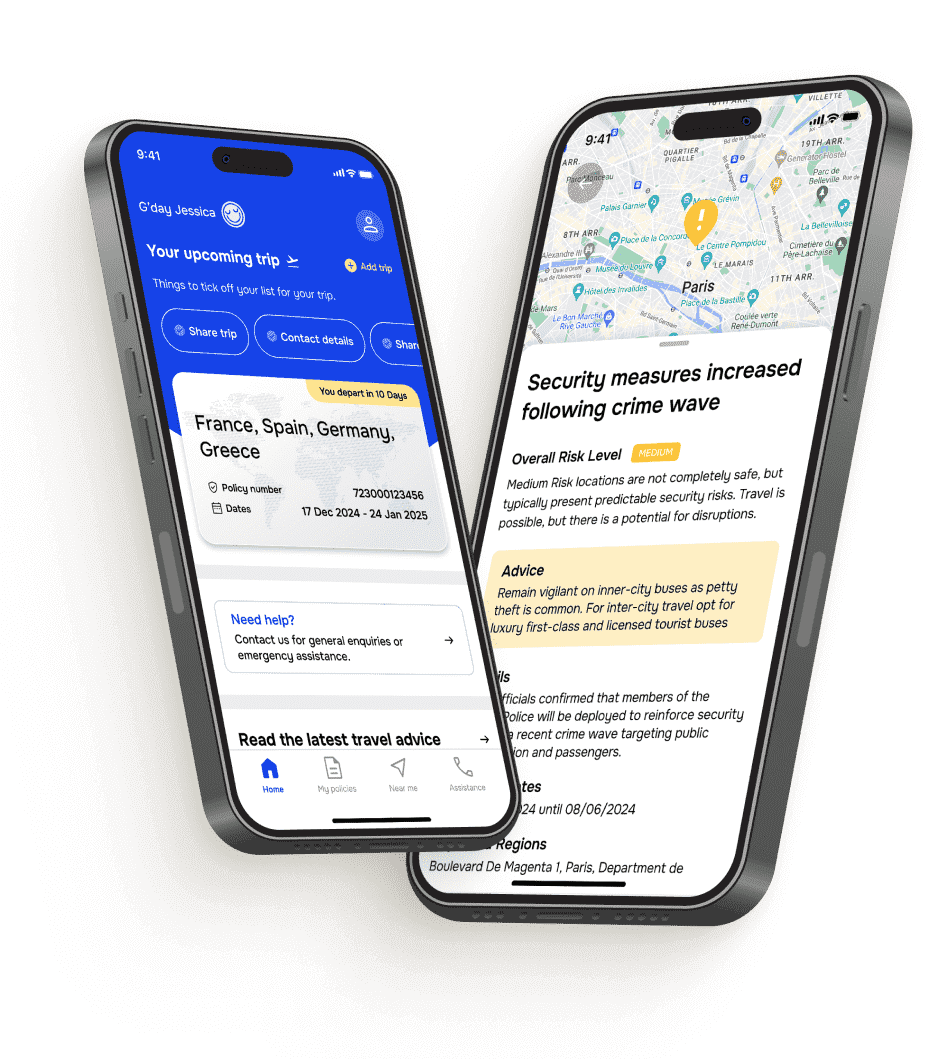

Buying our travel insurance including winter sports cover is as easy as doing a snow plough…

To start, hit the big ol’ quote button on this page. You’ll need to tell us your destination, dates of travel, and details of any other travellers you want included on your policy.

Then, you’ll need to select the travel insurance plan that best suits your snow holiday. You can pick from our Basic, Comprehensive and Comprehensive+ plans, depending on how much cover you want and how much you want to spend. If you’re unsure about which ones to choose, you can compare our travel insurance plans first.

Once you’ve decided on the plan you want, we’ll ask you some questions to help you tailor your cover to your trip. This is where you can add our Snow Sports Cover to your policy.

You’ll need to select ‘Yes’ when we ask if you’ll be doing any winter sports. Then, you can select the cover options that’s best for you:

- Snow Sports: provides cover for on-piste snow skiing, snowboarding, snowmobiling, and cross-country skiing.

- Snow Sports+: includes cover for the Snow Sports activities above, plus cover for snow skiing and snowboarding off-piste, and heli-skiing and heli-boarding on a guided tour with a licensed tour operator.

Good to know: Planning to travel with your own ski or snowboard gear? This is a great time to opt to increase your luggage limits if you need it. Check out the Luggage and Travel Document cover limits for your selected plan to see if it’s enough to cover your gear. If not, you can choose a limit from the available options that works for you.

If you still need help understanding which cover is right for your trip, call our team on 1300 72 88 22. We’ll happily guide you through our policy options, as well as help you buy a policy when you’re ready.

This Yes – if our Snow Sports Cover is included in your international travel insurance policy. If it is, we can provide cover for winter sports-related injuries that happen on the snow fields (provided you were complying with the conditions set out in the PDS at the time – rules are rules!). All three of our international plans include $Unlimited~ cover for emergency overseas medical expenses, so if you need us, we’ll be here for you.

If you’ve got a domestic travel insurance policy, we can’t include cover for medical, hospital, ambulance or dental expenses. It’s not because we don’t want to – it’s because you’ll have access to Medicare and potentially private health insurance while you’re in Australia.

Here’s more good news: It doesn’t matter if you’re hitting the mountains in Australia or overseas, if you’ve included one of our Snow Sports cover options in your policy and you’re injured while taking part in a covered winter sporting activity, we can still provide cover for other expenses such as additional transport and accommodation expenses.

Got a question that’s not featured here? Call our friendly team on 1300 72 88 22 or check out our top FAQs.

~Cover will not exceed 12 months from onset of the illness, condition or injury. .

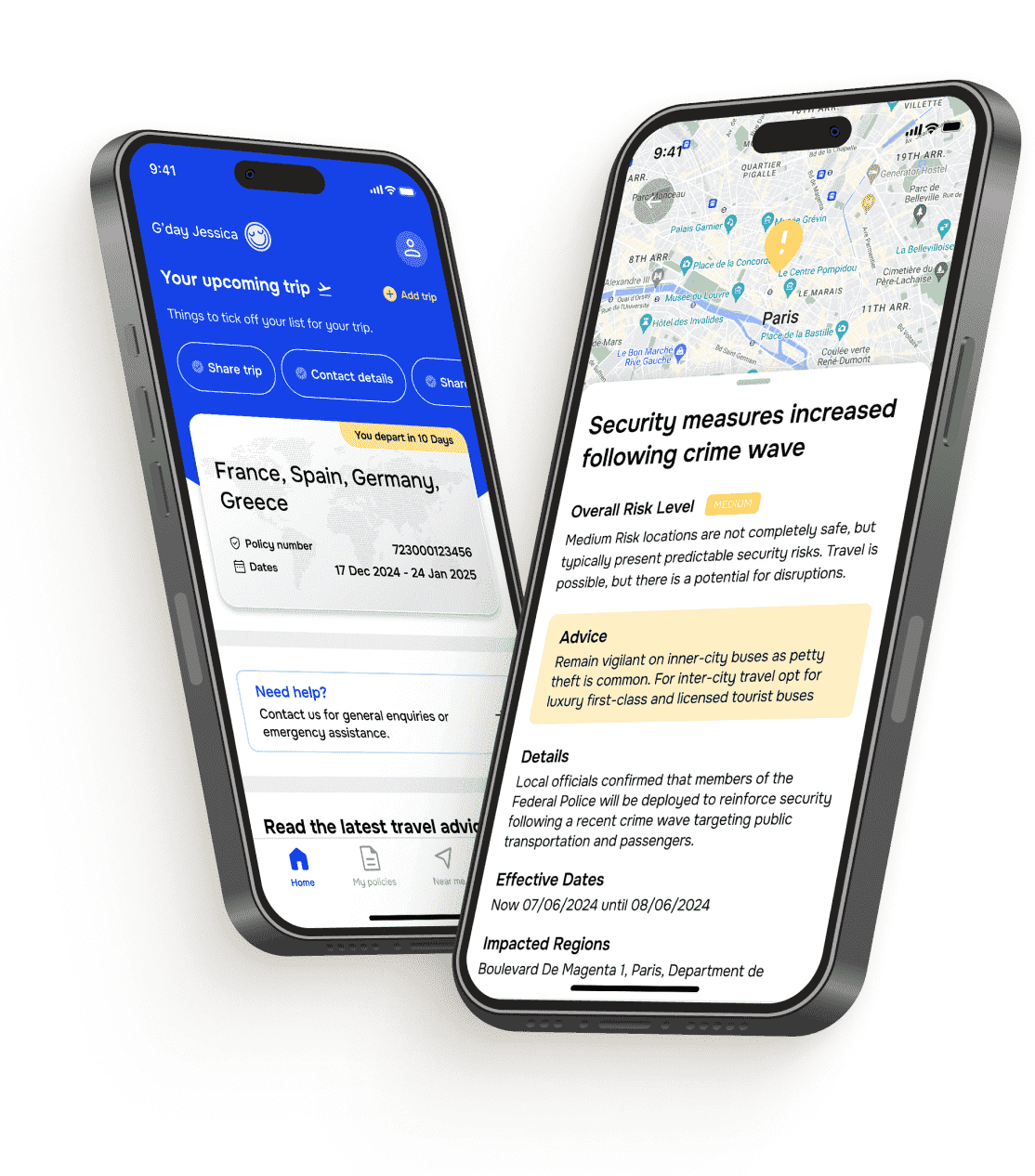

Want more care with your cover? We’re here for our global travellers

~300,000

The number of assistance calls we get each year from travellers who are in a pickle and need help.

~50,000

The number of assistance cases we handle each year (AKA travellers who need medical, safety or travel help).

~1,400

The number of medical evacuations and repatriations we help make happen each year for our travellers in need.

85,000+

The number of brilliant hospitals, doctors in our global network who help and support you overseas.

This is how our global Cover-More assistance team (also known as World Travel Protection) supported travellers across all our Zurich Cover-More brands and other third-party businesses in 2024 from our dedicated emergency travel assistance Command Centres located in Brisbane (Australia), Toronto (Canada) and London (UK). Want the global actuals for our 2024 assistance stats? They are: 294,491 assistance calls, 47,395 assistance cases, and 1,362 repatriations/evacuations.