Why pack our travel insurance with Accidental Death cover?

We’re here to help care for you in the good times and the not-so-good times. Here's to eating more in France, and hiking more in Peru knowing we’ll be there when you need us. We’ve got plans with accidental death cover and more, so you can worry less.

It's useful

You can choose the cover that matches your trip. International or domestic cover? We’ve got both.

It's supportive

You can get overseas medical cover for incidents, so you can focus more on getting better – not on paying all the bills.

It's flexible

You can add optional cancellation cover if you want protection from the unexpected before you’ve even left home.

It's dependable

You get access to emergency assistance at any time, from anywhere – from people who care.

What you get with our Accidental Death travel insurance cover

Holidays should be full of happy times – not hard times. So, you focus on the fun stuff and our Accidental Death cover can be there if things take a turn for the worst.

Oh, and we cover what we say we will, so check the table below to see which plans include our Accidental Death cover and their maximum cover limits.

You should also have a proper look at the Product Disclosure Statement (PDS) before you buy. It’s the source of truth when it comes to what’s covered, what’s not, plus any limits, exclusions, and conditions. It might not be the most thrilling part of your pre-holiday prep, but it’ll help you understand if our Accidental Death travel insurance cover is right for your trip.

Important bits for you to know:

~*Maximum liability collectively for Loss of Income, Disability, and Accidental Death: Comprehensive+ plan is $45,000, Comprehensive Plan is $30,000, and Inbound plan is $30,000.

Uncover more about our Accidental Death travel insurance

Our two cents? Wear a hat if you’re exploring in the sun. Pack a foldable reusable shopping back in your day bag. And get to know our cover before you buy.

It’s a not a very nice topic to think about, but it’s an important one. Accidental death travel insurance cover – sometimes referred to as accidental death and dismemberment travel insurance (AD&D) – provides financial support if you (or someone else on your policy) suffers an injury on your trip and dies while you’re travelling or within one year of the accident occurring. It can help your loved ones during an unimaginably tough time by providing funds to help cover the unexpected costs related to your death.

Yes, you’ll get our Accidental Death cover if you purchase one of these plans:

- International Comprehensive+

- International Comprehensive

- Inbound

- Domestic Comprehensive+

- Domestic Comprehensive.

Check out the table above for the maximum amount of accidental death travel insurance cover each of these plans include. Plus, don’t forget to read the PDS to uncover any cover conditions you need to know about.

If you buy one of the plans above and accidentally die on your trip or within one year of the accident, we can pay your estate the amount listed against our Accidental Death cover in your plan. For your loved ones to get this lump sum, you – or someone who’s sharing your policy – will need to have died from a covered injury. Check out the next section for all the details.

Want to know if our plans include travel insurance with accidental death and dismemberment cover? Most do, but we call it something different. We split it into two different types of cover: our Accidental Death benefit and our Disability benefit. Together, they provide cover that’s like what you might call accidental death and dismemberment travel insurance, but you’ll find them listed separately in the PDS.

Note to self: If you buy our Basic plan – whether it’s for a domestic trip or an overseas adventure – you won’t have our Accidental Death cover included in your Cover-More policy.

Not all types of death are covered under our Accidental Death cover, so it’s important you read the PDS for the full story.

But, in a nutshell, this is what you should know: the death must be caused by 'violent, accidental, visible, and external means’. Yes, this means the death needs to be because of an injury, not the result of a sickness or disease.

Good to know: The maximum payout listed next to Accidental Death in your policy is a combined maximum for these three cover types: Loss of Income, Disability, and Accidental Death. This means if you or your estate submit a claim under two or all of these sections of your policy, the maximum you’ll get depends on the plan you buy: Comprehensive+ plan = $45,000; Comprehensive plan = $30,000; and Inbound plan = $30,000.

We can’t cover absolutely everything, and when it comes to accidental death, there are some super important things you should know.

If you or someone else on your policy die on your trip – or within one year of getting home – because of:

- wilful or self-inflicted injury

- suicide

- attempted suicide

…we won’t be able to provide cover. Remember, it’s cover for accidental death, so the death must be the result of an accident.

If you or someone else on your policy suffers from a disabling injury while you’re on your trip, you’ll also need to follow the advice and treatment given by a qualified doctor. They’re the experts in this space – and are there to help you – so it’s important to do what they say.

The PDS has all the details, so give it a read. And don’t forget to check the policy conditions and general exclusions – they contain information about what’s relevant to our accidental death travel insurance.

We hope it’ll never happen, but if it does, our cover can help your family cope with your death beyond our Accidental Death cover.

Our plans have other benefits that can help during this time, including:

- Additional Expenses cover: for help with an overseas funeral or cremation, or the cost of returning your remains to Australia

- Overseas Medical Expenses cover: for help with medical costs if you’re injured overseas and need treatment, and if need to be evacuated home

- Access to emergency assistance: for support 24/7 when you or your family need it most.

Note to self: Check the PDS, because limits, sub-limits, conditions and exclusions apply – including how each claim is subject to our approval.

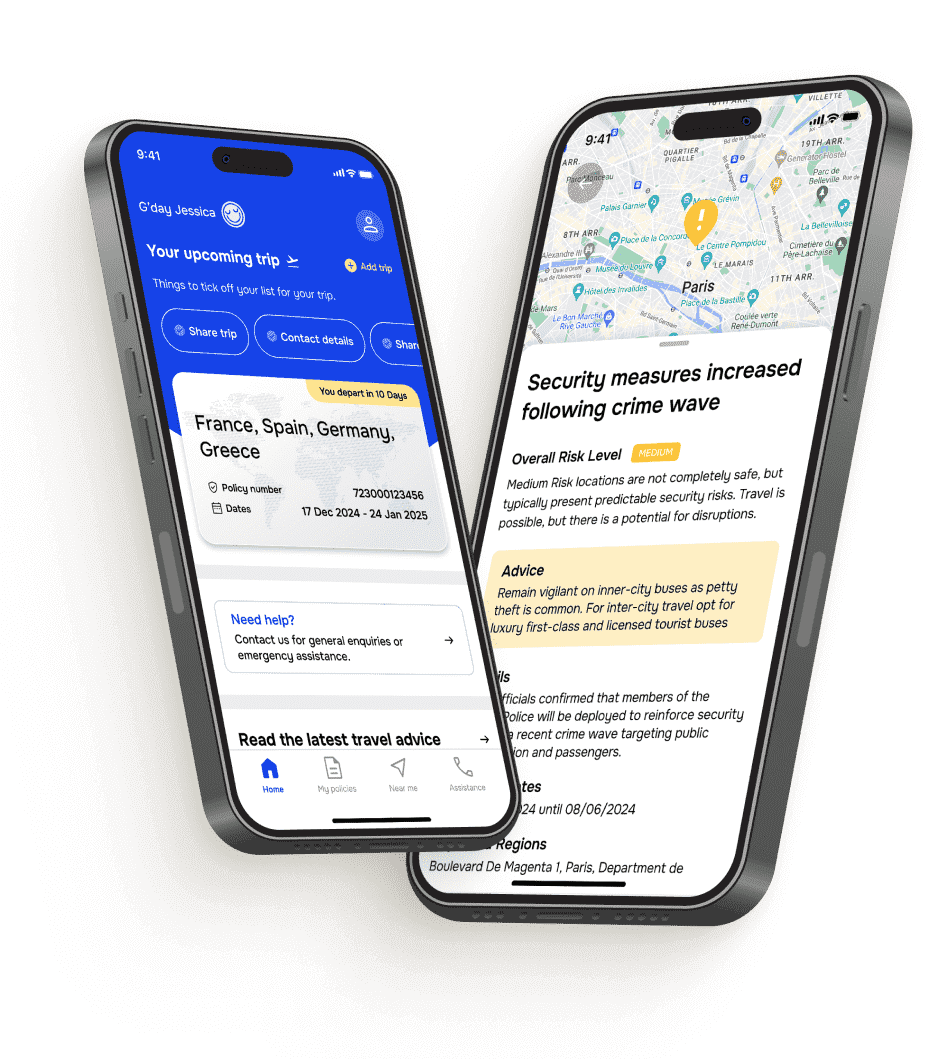

Want more care with your cover? We're here for our global travellers

~300,000

The number of assistance calls we get each year from travellers who are in a pickle and need help.

~50,000

The number of assistance cases we get each year (AKA our travellers who need medical, safety or travel help).

~1,400

The number of medical evacuations and repatriations we help make happen each year for our travellers in need.

85,000+

The number of brilliant hospitals, doctors in our global network who help and support you overseas.

This is how our global Cover-More assistance team (also known as World Travel Protection) supported travellers across all our Zurich Cover-More brands and other third-party businesses in 2024 from our dedicated emergency travel assistance Command Centres located in Brisbane (Australia), Toronto (Canada) and London (UK). Want the global actuals for our 2024 assistance stats? They are: 294,491 assistance calls, 47,395 assistance cases, and 1,362 repatriations/evacuations.