Why pack our travel insurance

with disability cover?

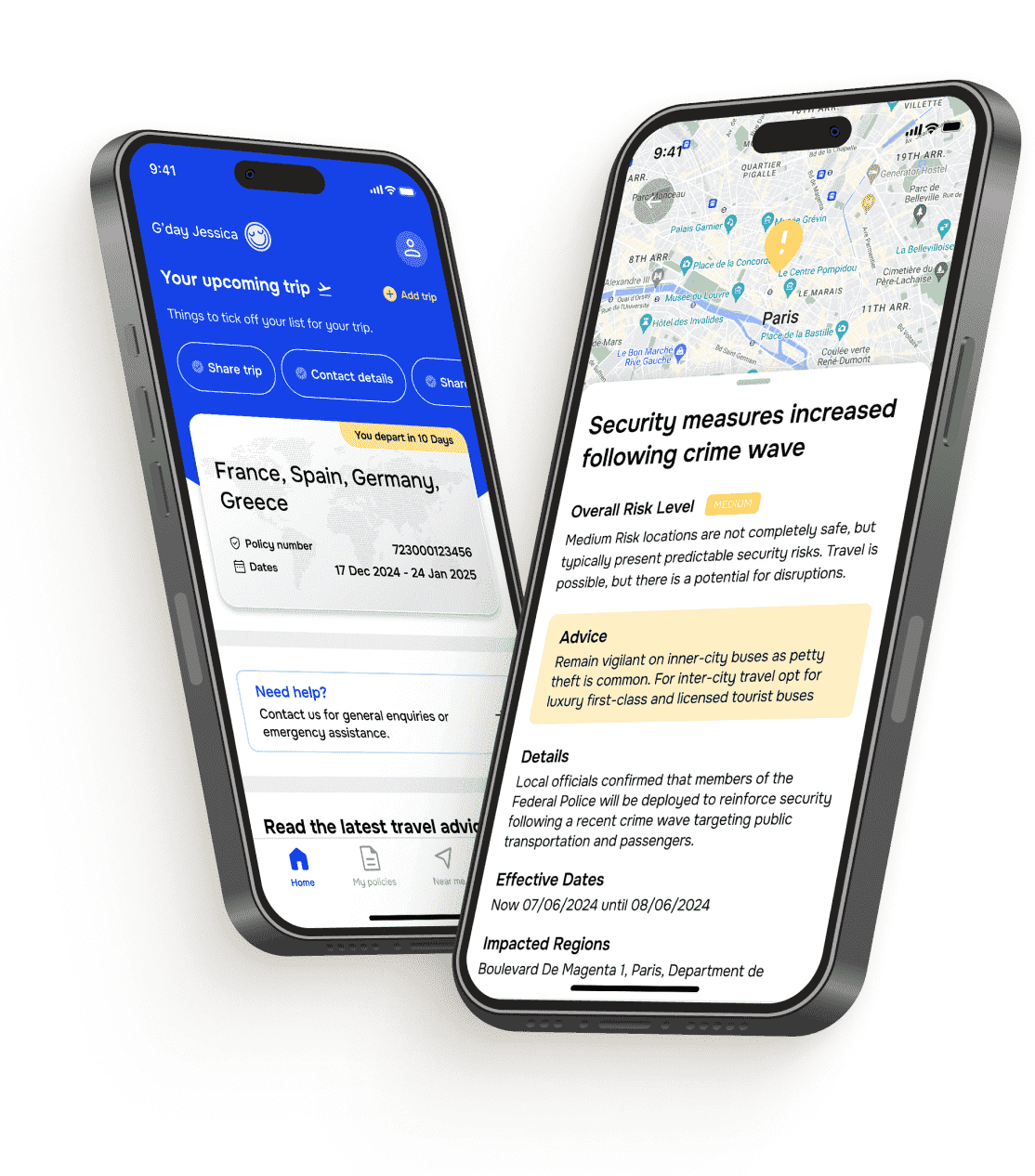

Your trip’ll likely be filled with great moments. But if there are some not-so-great moments? We can help care for you. So, here's to shopping in Paris, eating in Vietnam, and sailing in Greece knowing you’ve got cover that goes far beyond disability.

It's useful

You can choose the cover that matches your trip. International or domestic cover? We’ve got both.

It's supportive

You can get overseas medical cover for incidents, so you can focus more on getting better – not on paying all the bills.

It's flexible

You can add optional cancellation cover if you want protection from the unexpected before you’ve even left home.

It's dependable

You get access to emergency assistance at any time, from anywhere – from people who care.

What you get with our

Disability travel insurance cover

First things first: Our Disability cover is here to help you if you suffer a disabling injury while you’re travelling. It’s not designed to cover a current disability – that’s where our existing medical conditions cover comes in. It helps lots of Australians worry less when they explore the world, so check it out if you’re looking for travel insurance for people with a disability.

Alright, now onto our travel insurance with Disability cover. We cover what we say we will, so it’s important to peek at the table below. It shows which of our plans include this cover – and the maximum we’ll pay if your claim is approved.

Before you buy, you should also read the Product Disclosure Statement (PDS) to see what’s covered, what’s not, and any limits, exclusions, and conditions that apply to our Disability cover. It’s the source of truth, and even if it is a wee bit boring to read, it can help you choose the right cover for you and your trip.

Important bits for you to know:

*Maximum liability collectively for Loss of Income, Disability, and Accidental Death: Comprehensive+ plan is $45,000, Comprehensive plan is $30,000, and Inbound plan is $30,000.

Uncover more about our Disability travel insurance cover

Our two cents? Pack a foldable umbrella – it’s good for rainy and sunny days. Take a reuseable drink bottle to show your love for Mother Earth. And get to know our cover before you buy.

Travel insurance with disability cover isn’t cover for people with an existing disability; it’s cover that can help if you’re involved in an accident or injured while you’re on holiday and you’re left with a permanent disability.

Most holidays will be memorable for all the right reasons. But the unexpected can also happen. You could be on a road trip across the US when you’re involved in a car accident that causes you to lose a limb. You could be skiing down the slopes in the French Alps when a collision with another skier leaves you without sight in one eye.

If you’re left with a permanent disability after an incident on your holiday and you’ve got the right cover in place, disability travel insurance cover can help.

Yes, you’ll get access to our Disability cover if you purchase one of these plans:

- International Comprehensive+

- International Comprehensive

- Inbound

- Domestic Comprehensive+

- Domestic Comprehensive

The table above has the cover limit for each plan, while the PDS has all the cover conditions you need to know about. Give them a good read, yeah?

If you buy one of the plans above and suffer from an injury on your trip that leads to a permanent disability, we can help. The disability doesn’t need to occur while you’re travelling either – if your on-trip injury turns into a disability within one year of the accident, we can help ease your financial pain.

Keen to know if our plans include accidental death and dismemberment cover? They do, kind of. We just call it something different. We split the cover into two: our Disability benefit and our Accidental Death benefit. Together, they’re like accidental death and dismemberment travel insurance cover, but they’re listed separately in the PDS. Don’t forget to read this very important document so you’re across our cover before you buy.

Note to self: If you buy our Basic plan for a domestic or international trip, our Disability cover won’t be included in your policy.

We hope you never need to use it, but our Disability cover is for permanent disabling injuries only. It doesn’t cover temporary disabilities.

When it comes to our Disability cover, a permanent injury means:

- an injury that results in either permanent loss of sight in one or both eyes, with no reasonable prospect of improvement

- the loss of one or more limbs, within a year of the accident or injury occurring.

If you need to understand more about what this means for you, please chat to one of our customer service team on 1300 72 88 22.

Oh, and we’re still here to care for you if you get injured or sick while you’re travelling – that’s what our Overseas Medical and Dental Expenses cover is for. We include $Unlimited~ Overseas Medical Expenses in all our international plans to help you when you need it most.

Good to know: The maximum Disability cover payout listed in your policy is a combined maximum for these three cover types: Loss of Income, Accidental Death, and Disability. So, if you submit a claim under two or all these sections of your policy, the maximum you’ll get depends on the plan you buy: Comprehensive+ plan = $45,000; Comprehensive plan = $30,000; and Inbound plan = $30,000.

~Cover will not exceed 12 months from onset of the illness, condition or injury.

We can’t cover every single type of disability, so please read the PDS to truly get to know our cover.

But you should know this: the disability must be caused by 'violent, accidental, visible, and external means. Translation? The disability needs to be caused by an injury, not a sickness or disease.

You should also know this: If you or someone else on your policy suffers from a disability because of:

- wilful or self-inflicted injury

- suicide

- attempted suicide

…that happened on your trip, we won’t be able to provide cover. Remember, travel insurance provides cover unexpected events, so the disability-causing injury must be an unexpected accident.

We’re so happy to hear you’ve got the travel bug. We believe everyone deserves to explore, which is why we have cover for existing medical conditions.

The easiest way to check if we can provide cover for your disability is to get an online quote and fill out the medical assessment form. You can also give our team a call on 1300 72 88 22 to chat about your disability and how we can help cover your upcoming trip.

Good to know: There are some medical conditions we can’t cover, but that doesn’t mean we can’t protect other elements of you trip! When you buy a Cover-More policy, you’ll still have access to other benefits including Luggage and Travel Documents cover, Travel Delay, and more. You just won’t have cover for any scenarios related to medical conditions not included in your policy.

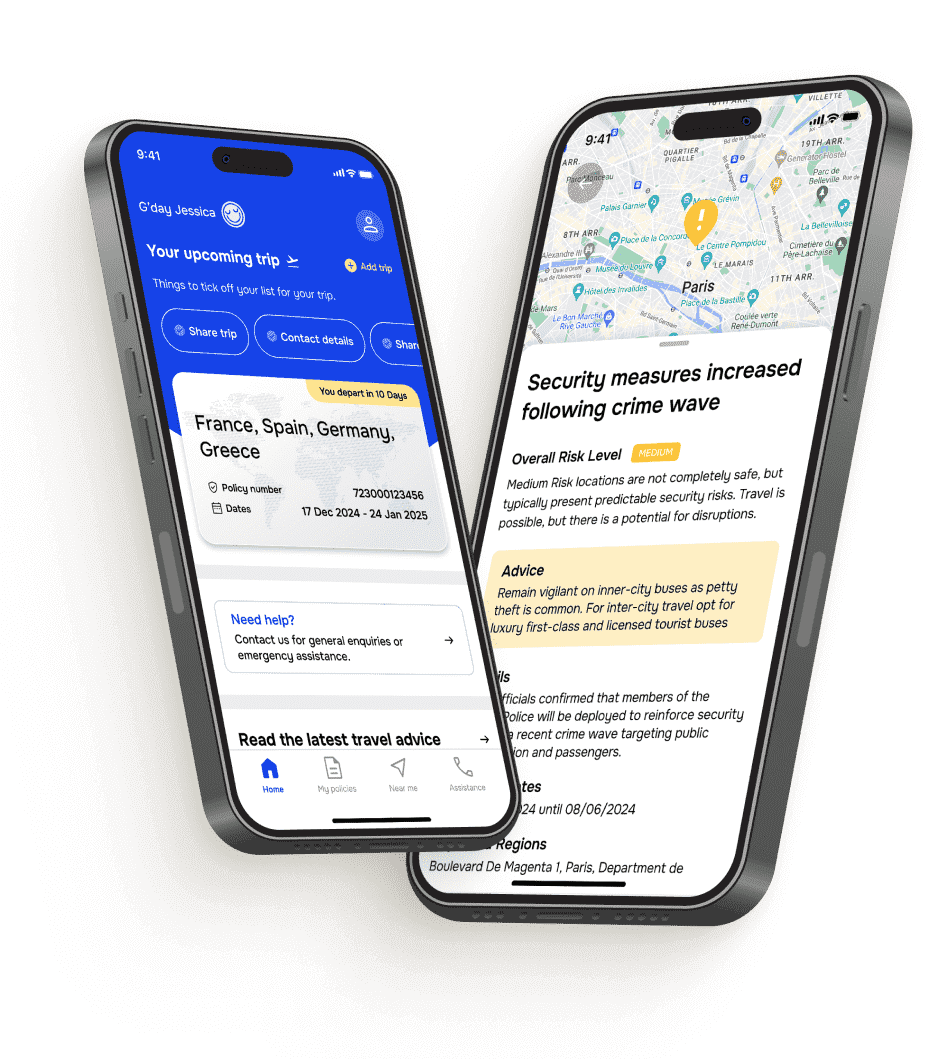

Want more care with your cover? We’re here for our global travellers

~300,000

The number of assistance calls we get each year from travellers who are in a pickle and need help.

~50,000

The number of assistance cases we handle each year (AKA travellers who need medical, safety or travel help).

~1,400

The number of medical evacuations and repatriations we help make happen each year for our travellers in need.

85,000+

The number of brilliant hospitals, doctors in our global network who help and support you overseas.

This is how our global Cover-More assistance team (also known as World Travel Protection) supported travellers across all our Zurich Cover-More brands and other third-party businesses in 2024 from our dedicated emergency travel assistance Command Centres located in Brisbane (Australia), Toronto (Canada) and London (UK). Want the global actuals for our 2024 assistance stats? They are: 294,491 assistance calls, 47,395 assistance cases, and 1,362 repatriations/evacuations.