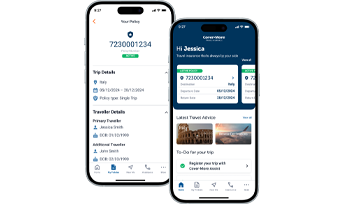

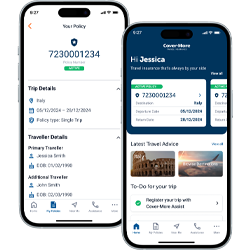

Travel insurance that’s always by your side

Your policy in your pocket... and more

Register your trip in our app for access to your travel insurance policy details, as well as up-to-date travel advice, real-time safety alerts and 24/7 emergency assistance, all in the palm of your hand.

Travel's back on - and we've got your back

Looking for the best travel insurance plan for your holiday?

Whatever your travel budget, style or needs, let's travel the world together - safely.

International Basic

Essential cover designed for Australian travellers on a budget.

Pre-trip cover if you're diagnosed with COVID-19

On-trip cover if you're diagnosed with COVID-19^##

Unlimited~ overseas emergency medical expenses^

Up to $5,000 luggage cover

Existing medical conditions cover available

Optional cancellation cover

Single Trip policies

Annual Multi-Trip policies^

Rental vehicle insurance excess

International Comprehensive+

Everything our Comprehensive Plan includes and more + higher benefit limits.

Pre-trip cover if you’re diagnosed with COVID-19 before travelling#

On-trip cover if you’re diagnosed with COVID-19 while travelling^##

Unlimited~ overseas emergency medical expenses^

Up to $25,000 luggage cover*

Existing medical conditions cover available

Optional cancellation cover with Cancellation Extensions

Single Trip or Annual Multi-Trip^^ policies

Rental vehicle comprehensive cover

Business trip benefits

Searching for COVID-19 cover?

To help you explore the world with confidence, our travel insurance provides cover for COVID-19-related:

Overseas medical costs*~#

Amendment and cancellation costs*^

Additional expenses*#^

*Limits, sub-limits, conditions, and exclusions apply.

~Medical cover will not exceed 12 months from onset.

#Cover for medical costs related to COVID-19 is not available on our Domestic Plans.

^A special excess will apply.

Holiday hasn't gone to plan?

You can submit a Cover-More travel insurance claim online at any time – and from anywhere.

Get emergency support, fast. We're here 24/7.

Contact Emergency Assistance

When adventure awaits...

we can help provide cover

Cruise

Setting sail for two or more nights? You'll need to let us know and Cruise Cover will be added to your policy.

Learn More

Snow Sports

Hitting the slopes? Consider protecting your winter getaway with one of our two levels of Snow Sports Cover.

Learn More

Adventure Activities

Planning on engaging in extreme activities? We've got two additional Adventure Activities Cover options for you.

Learn More

Motorcycle & Moped

Want to take to the road on two wheels? See if one of our Motorcycle/Moped Riding Cover options is right for your trip.

Learn MoreWe're by your side when you need us most

We've been protecting Australian travellers for over 35 years. Read our customers' Cover-More travel insurance reviews to discover how our expert team provides exceptional care during uncertain times.

Protect your trip with us - get a free travel insurance quote now.

GET QUOTEHow can we help you travel smarter?

Whether you’re a seasoned traveller or a first-timer, we’re here to help you feel empowered to travel further, safely.

Finding cover for Existing Medical Conditions (EMCs)

Have an EMC? We can provide cover for various conditions to help keep you exploring, safely.

Read More

7 ways COVID-19 has changed the way we travel

Worried about travel risks during COVID-19? Discover how you can help ensure a safer trip.

Read More

What you should know before you hit the slopes

Planning a ski trip at home or abroad? Don't depart without reading our expert advice.

Read MoreGot a question about travel insurance? We're here to help

Travel insurance is a specific type of insurance that helps cover several costs and disruptions when travelling both domestically and overseas. Levels of cover differ per plan; however, travel insurance typically protects against trip cancellation, delays, lost luggage and personal belongings, overseas medical expenses and repatriation, and personal liability.

Most travel insurance providers offer single or multi-trip policies, which can cover multiple countries within a specific timeframe. Things like the destination, length of trip, optional additional cover for specific activities and pre-existing medical conditions all help determine the cost of a travel insurance policy.

The cost of a travel insurance policy varies from traveller to traveller because various factors affect the amount payable.

At Cover-More, we consider a number of factors when calculating the total amount payable. The following is a guide on these key factors, how they combine and how they may impact the assessment of risk and therefore the premium paid:

- Area: higher risk areas cost more.

- Departure date and trip duration: the longer the period until you depart and the longer your trip duration, the higher the cost may be.

- Age: higher risk age groups cost more.

- Plan: International Comprehensive+, which provides more cover, costs more than International Comprehensive or Domestic.

- Excess: the higher the excess the lower the cost.

- Cruise cover: additional premium applies.

- Cancellation cover: on some policies you can choose your own level of cancellation cover. The more cancellation cover you require, the higher the cost may be.

- Adding cover for Existing Medical Conditions and pregnancy (where available): additional premium may apply if a medical assessment is completed and cover is accepted by us.

- Options to vary cover (where available): additional premium applies.

While a cheaper policy cost upfront may seem appealing, always read the Product Disclosure Statement to ensure your needs are adequately covered should an incident occur.

Travel insurance protects you when travelling domestically or internationally by providing coverage against unforeseen circumstances that may impact your travel plans. By purchasing travel insurance with cancellation cover prior to departure, your policy can help by providing cover for the costs of trip cancellations should you no longer be able to travel, as well as the costs of overseas medical treatment, lost passports, and personal items while you’re travelling.

The customer usually pays for these costs upfront, before being reimbursed by the travel insurer upon claim approval. To approve a claim, travel insurers require documentation such as medical reports, itemised medical bills or police reports to confirm the incident occurred.

However, at Cover-More, if our customer becomes ill overseas, they can also contact our 24-Hour Emergency Assistance team for support and to seek approval for expensive medical bills to be paid directly by us to the medical care provider/s instead.

Always read the Product Disclosure Statement before purchasing a travel insurance policy to ensure it provides adequate coverage for your circumstances.

Unfortunately, travel insurance can’t cover absolutely everything. This highlights the importance for travellers to read the Product Disclosure Statement before purchasing to avoid becoming frustrated if claims are unsuccessful. It will contain details on the situations you likely won’t be covered in, including cancellation, pre-existing medical conditions, theft or loss of belongings, adventure sports, COVID-19 scenarios and more.

For full details of the exclusions within our Cover-More travel insurance plans, consult the Product Disclosure Statement .

The best time to purchase travel insurance is as soon as a trip is booked, as this can increase protection. When purchased ahead of time, a Cover-More customer can cancel their travel insurance policy for a full refund within the 21-day cooling-off period. If the policy is purchased before departing on the trip, claims for rearrangements and cancellations caused by unforeseen circumstances can also be made where cancellation cover is added to the policy.