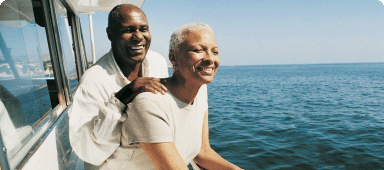

Why pack our travel insurance for cruise holidays?

When you cruise with us at Cover-More, we can help you stay financially buoyant should something go wrong on land or the high seas, so you can see more, laugh more, and eat more on your cruise holiday.

It’s flexible

You can get cover for your cruise holiday, whether you’re venturing across the ocean on an international cruise or staying closer to home on your holiday.

It’s supportive

You get overseas medical cover for incidents that happen on board and on land, so you can focus on getting better – not on paying all the bills.

It’s dependable

You get access to emergency assistance at any time, from anywhere – from people who care and know their stuff.

It’s helpful

You get ship-to-shore cover for medical emergencies, so you can get the help on dry land if the cruise ship’s facilities can’t offer you what you need.

What you get with our cruise travel insurance cover

We know you want a cruisy – ahem – cruise holiday. That’s why our Cruise Cover offers cover that can help you worry less on the high seas.

We also cover what we say we will. So, take a look at the table below to see what’s covered, what’s not, and the limits for our Cruise Cover. Because if it’s not covered by your policy, we won’t be able to pay the bill.

Important bits for you to know:

~Cover will not exceed 12 months from the onset of the illness or injury.

^Cover chosen applies per policy.

If you do not tell us about your cruise, claims in any way related to your multi-night cruise, and multi-night cruise travel or that arise while on a multi-night cruise are specifically excluded by this policy.

Uncover more about our travel insurance for cruise holidays

Our two cents? Hold onto your hat if it’s windy on board. Take in the uninterrupted sunsets (and sunrises if you’re an early bird!). And get to know our cover before you buy.

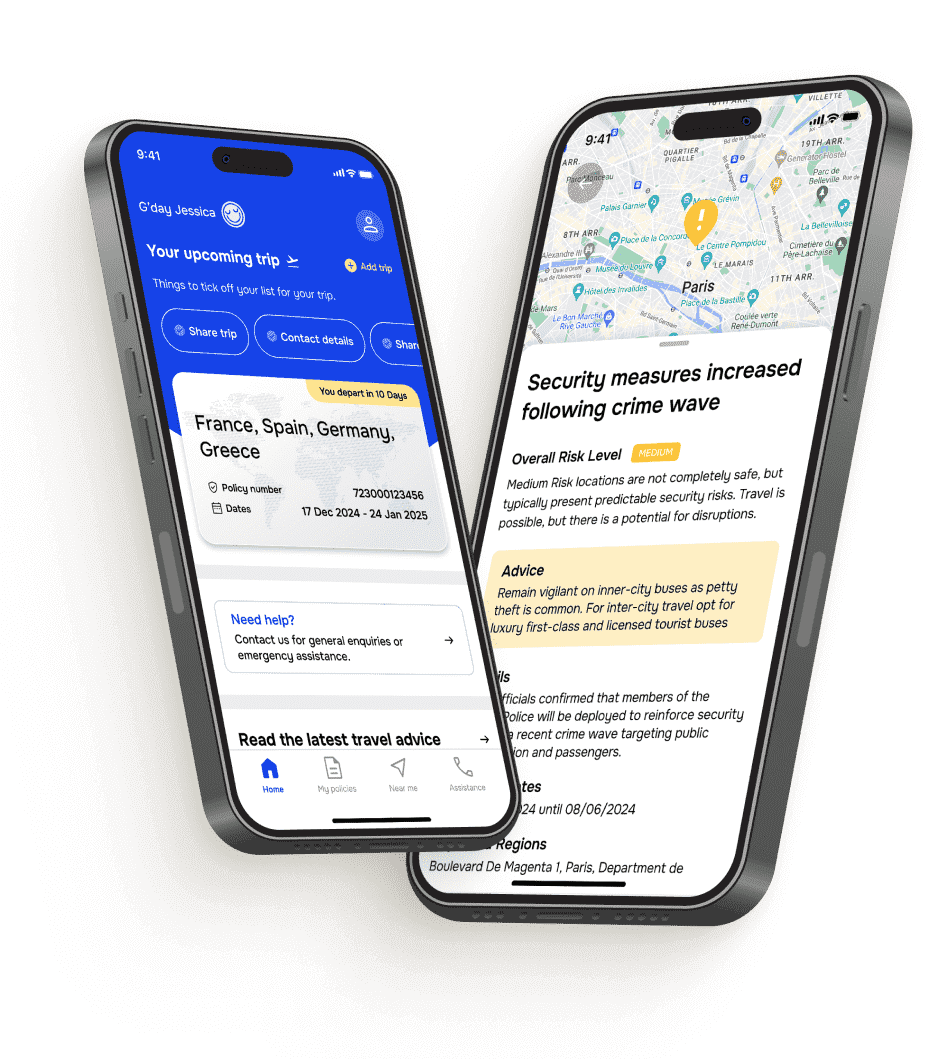

Cruises can be your boarding pass to ultimate relaxation. But if the tide turns and you become sick or injured, your luggage goes on a trip of its own, or you miss a shore excursion, it can be expensive to make the situation right. Cruise travel insurance cover can help ‘correct the ship’ when things go awry.

If you choose to cruise with us, we can help you worry less about the unknown and be there to care for you when the unexpected happens. Our Cruise Cover can protect you against onboard medical expenses, a worst-case medical evacuation, the cost of replacement luggage and even trip cancellation (up to the cover amount you’ve included in your policy).

Yes, our travel insurance for cruising lets you chart the waters ahead with confidence, knowing you’ve got us – an experienced crew – behind you, always.

Firstly, you’ll want to make sure you read the PDS to check if our cruise travel insurance cover is a good fit for your trip.

It is? Great. Now it’s time to get a quote for your cruise holiday. You can do this by clicking on the ‘Get quote’ button at the top and bottom of this page, or by calling us for a chat on 1300 72 88 22.

Our plans don’t automatically include cover for cruises, so here’s how to include our Cruise Cover in your policy. When you’re looking at our quote box, follow these steps:

- In the ‘Where are you going?’ section: If you’re going on an overseas ocean or sea going cruise, you’ll need to select the country or region you’re going to – or if you’re going all over, select ‘Anywhere in the world’. If you’ve going on an Australian ocean or sea cruise, choose ‘Domestic cruise’ (not ‘Domestic’). You’ll then be offered an international plan. This may sound a little odd, but you’ll need overseas medical expenses cover for your domestic cruise, and our domestic plans exclude cover for any medical expenses in Australia.

- Next, choose the dates of your trip, add the age of the traveller(s) you want to include, and then select ‘Get quote’. Now you can select a plan option that suits you, including whether you want a single trip policy or an annual multi-trip policy if the option is available.

- You’ll then be asked if you are travelling for two or more nights on a sea or ocean cruise. If you’re reading this because you’re interested in our Cruise Cover and going on a cruise for two or more nights, the answer to this question will need to be ‘Yes’ for cover to be added to your policy. If you select ‘No’, you’ll have no cover for anything related to your cruise. Eek!

Slightly-boring-but-important information: If you include our Cruise Cover in your policy, an additional premium will apply. To prove you’ve got cover, Cruise Cover will be listed on your Certificate of Insurance when it arrives in your inbox, along with the rest of your policy information. - Continue to follow the prompts to complete your policy purchase (read: tell us your details, declare your existing medical conditions, and tell us how you want to pay), and then buy your policy. Easy.

Great question. When it comes to our cover, where you’re cruising matters. Here’s what to put in ‘Where are you going?’ section when getting a quote:

- Are you cruising within Australia on an inland waterway (e.g. a Murray River cruise) or within Australian coastal waters (e.g. a Kimberley cruise where the cruise doesn’t leave these waters)? You’ll need to choose or enter ‘Australia’ to get a domestic plan. You don’t need our Cruise Cover for this type of cruise – your base plan will provide the cover you need. (You’re welcome!)

Are you cruising from a port in Australia to other port(s) in Australia and the cruise ship doesn’t stop at a port outside of Australia (e.g. a cruise from Sydney to Brisbane or a Kimberley cruise that leaves Australian waters)? You’ll need to choose or enter ‘Domestic cruising’, as you’ll need an international plan to ensure you’ve got our Overseas Medical and Dental Expenses cover (including emergency repatriation/evacuation) in your policy.

Are you cruising overseas, possibly stopping in many destinations (e.g. a European cruise, a Caribbean cruise, or a cruise from Hong Kong to Sydney) or cruising from a port in Australia to another port or ports outside Australia (e.g. Sydney to Singapore)? You’ll need to enter every country you will be travelling to or enter a region.

Are you going on a Kimberley cruise, but you’re not sure if you’ll be leaving Australian waters? It’s always best to check with your cruise provider before you get cover.

Absolutely. All our plans include cover for 30+ existing medical conditions (if you meet the criteria in the PDS, of course), whether you’re hitting the high seas or sticking to land.

If your condition(s) aren’t all on this list or you don’t meet all the criteria for cover to apply automatically, you can take the online medical assessment during the quote process to apply for cover for all your conditions. If we’re happy to provide cover for your medical condition(s), you may – or may not! – have to pay extra to include the cover in your policy. We’ll let you know when you complete the assessment.

Oh, and if you decide to tell us about some medical conditions and not others – or don’t want to pay more to include cover for any condition(s) – you run the risk of related claims being denied. Don’t say we didn’t tell you!

Good to know: If you don’t include cover for one or more of your existing medical conditions – or we’re unable to cover your condition(s) – we can still give you cover for other travel mishaps. Think: lost luggage and travel documents, and any illness or injury not relating to your existing medical condition(s).

Want to know more? Head to our existing medical conditions page for all the details.

It’s always smart to pack travel insurance, but when it comes to our Cruise Cover, there are a couple situations where you won’t need it. Why? Sometimes our base plan can provide you with the cover you need.

If you are:

- cruising on an international river cruise (e.g. on the Rhine or the Danube River)

- cruising on an Australian river cruise (e.g. on the Murray River)

- cruising in Australian coastal waters (e.g. certain Kimberley cruises)

- not cruising on a cruise ship on the sea or ocean

- only cruising on a cruise ship on the sea or ocean for only one night

- travelling on a ferry

- sailing

…then you don’t need to include our Cruise Cover in your policy.

Good to know: Sorry, but we don’t cover sailing in international waters – only in Australian coastal waters and the coastal waters of other countries.

You may not like this, but the answer is a hard no.

Cruise ships often don't have to have doctors on board who are registered to practice in Australia. So, if you’re unwell and see a doctor on board, the visit likely won’t be covered by Medicare, and you may end up with out-of-pocket expenses. No one wants that, right?

That’s where our domestic cruise travel insurance cover comes in handy. When you cover your Australia sea or ocean cruise with our Cruise Cover, you get cover for unexpected medical costs. This means you can sail more and worry less, knowing we’ll be here to help if you need us.

It’s simple to get cover. Just enter or select ‘Domestic cruising’ as your destination when getting a quote and we’ll do the rest.

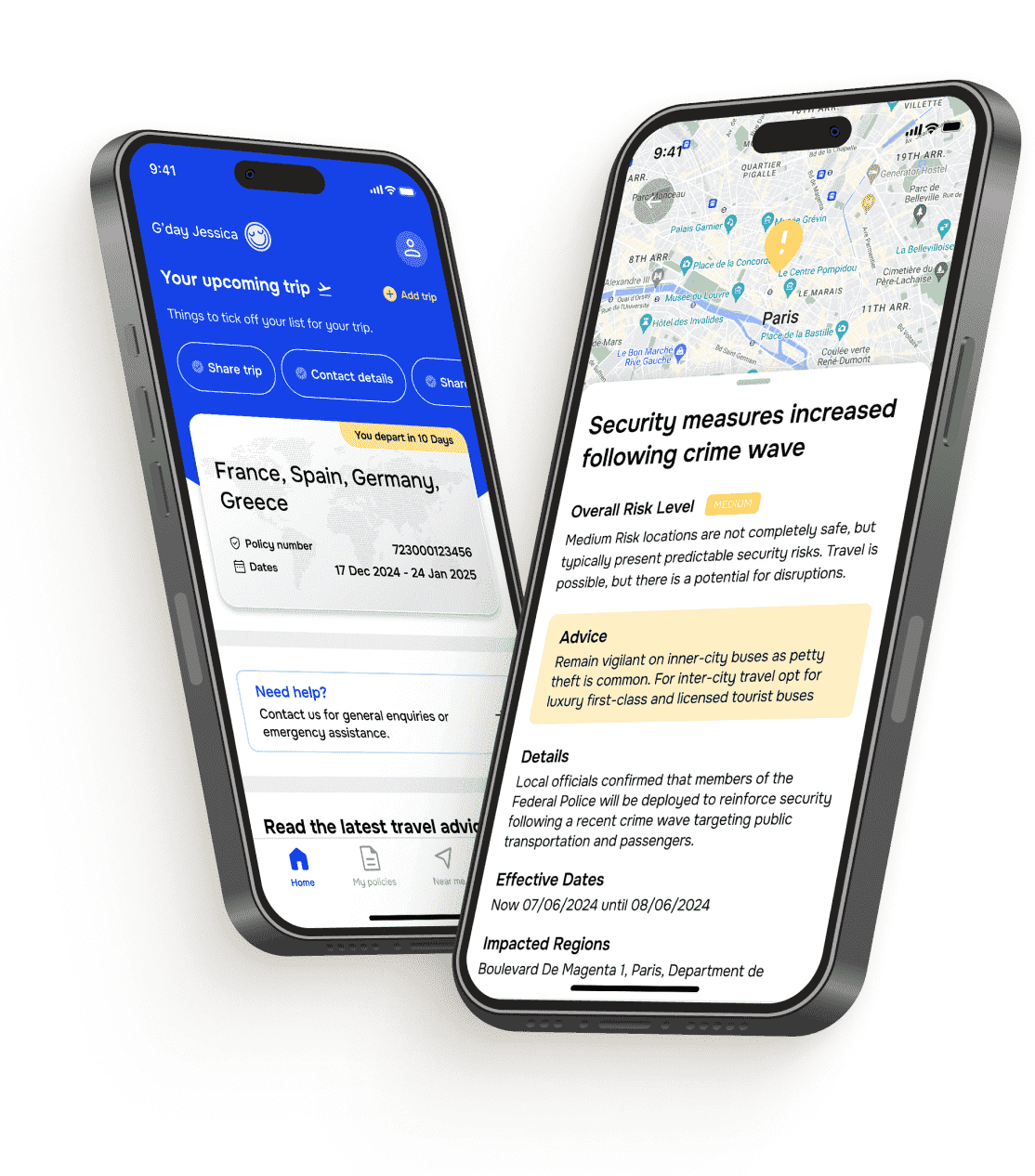

Want more care with your cover? We’re here for our global travellers

~300,000

The number of assistance calls we get each year from travellers who are in a pickle and need help.

~50,000

The number of assistance cases we get each year (AKA our travellers who need medical, safety or travel help).

~1,400

The number of medical evacuations and repatriations we help make happen each year for our travellers in need.

85,000+

The number of brilliant hospitals, doctors in our global network who help and support you overseas.

This is how our global Cover-More assistance team (also known as World Travel Protection) supported travellers across all our Zurich Cover-More brands and other third-party businesses in 2024 from our dedicated emergency travel assistance Command Centres located in Brisbane (Australia), Toronto (Canada) and London (UK). Want the global actuals for our 2024 assistance stats? They are: 294,491 assistance calls, 47,395 assistance cases, and 1,362 repatriations/evacuations.